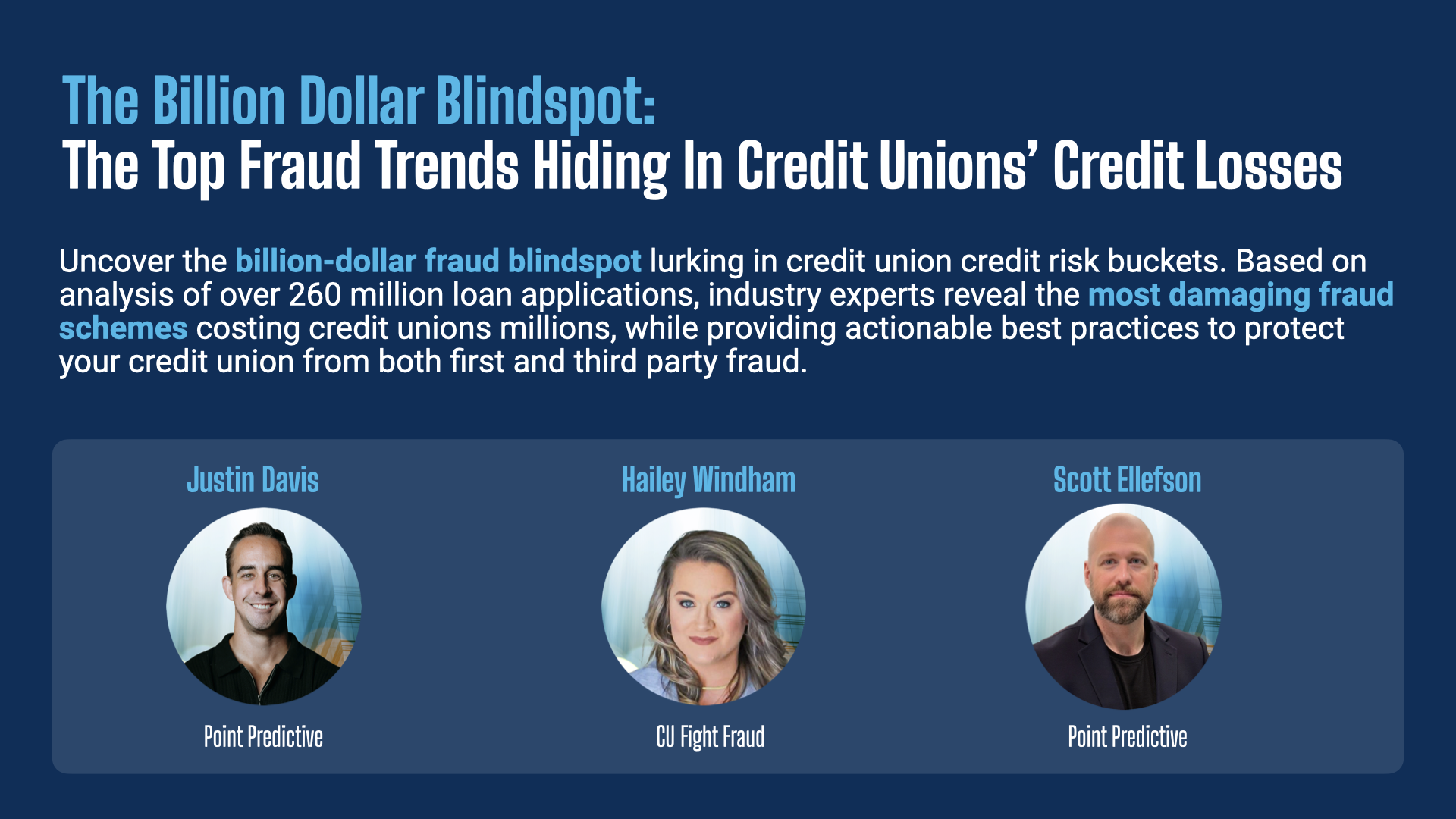

There’s a billion-dollar fraud blind spot lurking in your credit risk. Hear from these credit union fraud experts on how you can find it, and stop it from happening in the future.

The live webinar date has passed, but you can still access the full recording by completing the attached form.

Why You Can’t Miss This

-

Data-Driven Insights: What fraud analysts uncovered in recent analysis of $4 trillion in loan applications.

-

Hidden Fraud Exposed : Understand how investigators identified that over 61% of early payment default losses had fraud on the initial application.

-

Actionable Strategies: Hear from fraud experts on practical steps your credit union can take to identify and prevent fraud.

-

Fraud Automation: Hear how credit unions use consortium data and AI to automate fraud checks and reduce manual reviews.

What You’ll Learn

How To Identify Fraud On Your Portfolio And Stop It

- Key fraud trends, credit washing, synthetic identity, bust-out, and income fraud

- Best red flags and operational practices to stop fraud at your credit union.

How To Find Hidden Fraud So You Can Build A Better Program

- How approved loans can still conceal fraud

- Portfolio risk pockets you may be overlooking